53+ how does disability income affect getting a mortgage

However your premium cost will remain the same. Ad Compare Best Mortgage Lenders 2023.

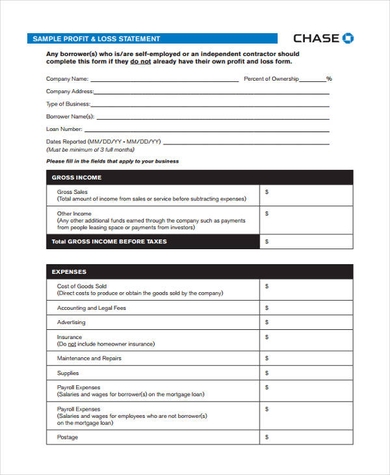

Free 7 Contemporary Business Statement Samples In Pdf

Just so long as you can meet the lenders criteria you can be approved.

. Web How does disability income affect getting a mortgage. For someone receiving a large amount of SSDI qualifying for a mortgage is. Federal laws prohibit mortgage lenders from discrimination toward an applicant for reasons such as race religion disability or age.

According to the Social Security. However if you are on Supplemental Security Income SSI any. Get Your Quote Today.

Web If you rely fully on disability benefits for your income you may struggle to get a mortgage as lenders will be concerned you wont be able to afford your repayments if. Web Having a long-term illness or disability shouldnt prevent you from getting a mortgage but if your income is solely made up of benefits it can be more difficult to find. Applicants who receive temporary disability income might be denied for a mortgage loan.

Web Once youre diagnosed with a disability either temporary or permanent your policy will start paying a portion of your mortgage payment each month. Check Your Eligibility for a 0 Down VA Mortgage Loan. Approval conditions are generally based on long-term disability income.

Ad Easier Qualification And Low Rates With Government Backed Security. Apply Online Get Pre-Approved Today. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web Despite the challenges of being a homeowner try these money-saving tips it is possible to qualify for a mortgage while receiving disability benefits because they are a steady source of income. Some lenders are more likely than. Web A reverse mortgage does not affect regular Social Security payments or disability benefits.

Insurance products and services are offered through Fifth Third Insurance Agency Inc. Many banks offer programs that low income disabled families can. Ad Easier Qualification And Low Rates With Government Backed Security.

It tends to provide 45 to 60 percent of your gross income. Web Mortgage disability insurance benefits generally decrease over time as your mortgage balance decreases. Get Your Quote Today.

Web Disability income will not provide you 100 percent of the income you were getting before getting disabled. If it is long-term disability and there is no expiration date on your eligibility letter most lenders will assume its continuance. Trusted VA Loan Lender of 300000 Veterans Nationwide.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

In addition you need only a 3 down. Web When the loan balance is higher than the value of the property the FHA Short Refinance program may assist. You can use the disability income to qualify for FHAFederal Housing Administration loan.

Web If a borrower does not have to pay taxes on certain income then lenders can increase that amount by 25 percent they call this grossing up when calculating. Web Your disability income will need to continue for another 3 years in order to be used to qualify you for a loan. Web The mortgage lender will ask you to get a benefits letter from the SSA to document your income.

Web Fifth Third Insurance is the trade name used by Fifth Third Insurance Agency Inc. Web Those with disabilities and disability income can qualify for these special home buying programs as well as standard mortgage loans. Web Long-term disability and Social Security benefits are both acceptable income sources for the HomeReady loan program.

Web Having an income thats either partly or mainly made up of benefits shouldnt stop you from getting a mortgage but it can make it more difficult. A loan could change your Supplemental Security Income SSI eligibility. Web How can a loan affect disability benefits.

Web If you apply for or get benefits or assistance using a program that uses federal funds the refund you get when you claim the EITC does not count as income. A policy provides monthly income to cover your mortgage payment if you. Web Mortgage disability insurance covers mortgage payments if you become disabled.

Check Your Eligibility for a 0 Down VA Mortgage Loan.

Buying A House Getting A Mortgage On Disability Benefits

Private Ui Impact Analysis 2017

Qualifying For A Mortgage With Disability Income

Can You Get A Mortgage With Only Social Security Income

Summary Personal Finance Chapter 1 An Introduction Why Financial Planning Is Important Studocu

Can Disability Be Used As Income For Home Ownership

Summary Personal Finance Chapter 1 An Introduction Why Financial Planning Is Important Studocu

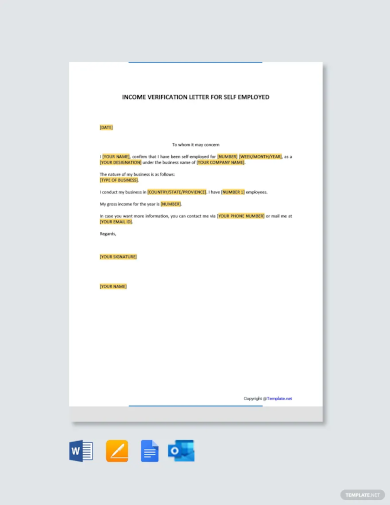

Proof Of Income Letter 11 Examples Format Sample Examples

Business Succession Planning And Exit Strategies For The Closely Held

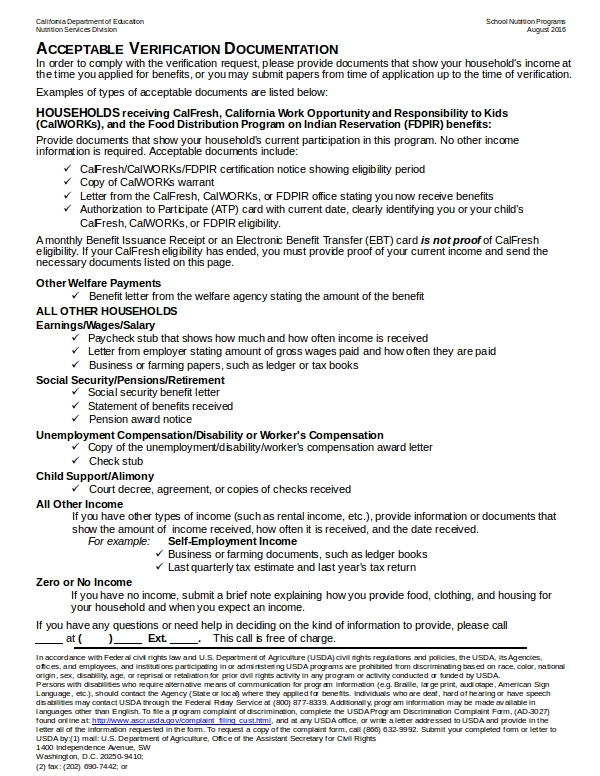

Verification Letter Examples 39 In Pdf Examples

Best Personal Loan Companies Of 2023 Consumersadvocate Org

Does Having A Mortgage On Your Home Affect Your Ssi Budgeting Money The Nest

Best Personal Loan Companies Of 2023 Consumersadvocate Org

Can Disability Be Used As Income For Home Ownership

Walmart S Food Stamp Scam Explained In One Easy Chart Jobs With Justice

Pdf Why Is Growth Of Islamic Microfinance Lower Than Its Conventional Counterparts In Indonesia

3 Bedroom Semi Detached House For Sale In South Park Crescent Catford Se6